-

Scope: Marketing → Signup → Security → Onboarding

-

Team: 4 design pods, 1 content designer (lead)

-

Audience: New QuickBooks SMB customers

-

Duration: ~6 months

Why we started

Discovery research revealed a critical retention driver: customers who connected their bank accounts within their first session were significantly more likely to stay engaged and succeed.

But connecting a bank early required trust, clarity, and a smoother signup experience, something the old journey didn’t deliver.

-

Early bank connectors were 40 % more likely to stay active after 30 days.

The Challenges

-

Balancing regulatory and security requirements with a simple, confident experience.

-

Helping customers understand and complete financial setup without overwhelm.

-

Aligning copy, flow, and tone across marketing, signup, and in-product surfaces.

My Role

Principal Content Designer and Strategist

I led content and UX writing across the connected journey, collaborating with teams from marketing, pricing, signup/security, and onboarding.

I defined the content strategy, messaging hierarchy, and interaction copy that guided users confidently from website to bank connection.

The Collaboration: A connected journey across four teams

1. Marketing & Signup Experience

We aligned voice and interaction patterns from the first marketing touchpoint through to signup and onboarding.

2. Onboarding & Bank Connection

We embedded the bank connection flow early in onboarding to help customers see value faster.

How we built & tested the content experience

UX Writing Process

We followed a structured process to ensure all content was consistent, clear, and effective across the onboarding journey.

-

Research and discovery: ran qualitative and quantitative studies to understand user behaviours, focusing on their first interactions with QuickBooks.

-

Voice and tone principles: defined a tone that was confident and supportive while balancing regulatory precision with warmth and clarity.

-

Cross-team collaboration: worked closely with marketing, design, product, and compliance to align terminology, messaging patterns, and success metrics across touchpoints.

-

Content prototyping and testing: iteratively tested copy in flows and prototypes to validate comprehension, tone, and clarity.

-

Refinement and governance: documented patterns, created re-usable content structures, and built guidelines to scale consistency globally.

UX Writing Approach

Our approach to language focused on reducing friction, building trust, and helping users see value quickly.

-

Simplify complexity: broke down technical or regulatory content into simple, actionable steps.

-

Guide with clarity: used progressive disclosure and micro-copy to reassure users through each decision.

-

Build confidence: used plain language to explain why certain actions (like connecting a bank) mattered.

-

Consistent tone: maintained a conversational, expert-yet-approachable voice from marketing through onboarding.

-

Evidence-based iteration: refined language using feedback and testing results, ensuring clarity and confidence at every touchpoint.

Key highlight

-

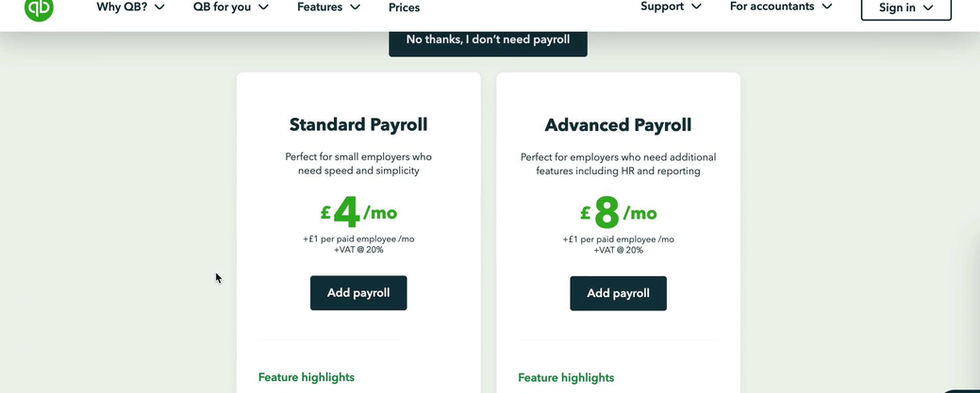

Clear Messaging at Pricing: simplified plan comparison and addressed trust signals early.

-

Regulated Simplicity: guided users through required steps with plain-language explanations.

-

Job-Done Clarity: copy reinforced progress and success at each milestone.

Results

The redesigned onboarding experience delivered measurable improvements in activation, trust, and retention.

-

Improved early engagement: most users connected a bank within the first three minutes of onboarding.

-

+32% increase in 30-day trial-to-subscription conversion (T2S).

-

67% of new customers opted to connect their bank during onboarding, building trust and reducing setup friction.

-

Higher retention: focusing on essential setup tasks in the first 30 days helped customers stay active and succeed faster.

-

Scaled globally: following the success of the UK experience, the new flow was adapted and rolled out across the US, Australia, and Canada.